Tether and Bitfinex Introduction – Bennett's Articles

Tether and Bitfinex are two of the most important companies in the cryptocurrency ecosystem. Tether is the largest stablecoin, and the primary driver of volume and liquidity. Bitfinex used to be the largest cryptocurrency exchange, and still is a frequently used exchange. Tether and Bitfinex have an incredibly problematic past and are quite possibly the largest corporate fraud in history.

Leading up to the founding of Bitfinex Raphael Nicolle, a helpdesk technician, was active on BitcoinTalk promoting a high yield lending program run by Trendon Shavers (pirateat40). This program ended up being a ponzi scheme that was prosecuted by the Department of Justice. (Archive) Despite losing the majority of his Bitcoins in this scheme Raphael was not deterred.

He immediately launched his own Over the Counter or OTC desk and used that to start his own high yield lending program. The premise of this program was that people would lend him their bitcoins and in return he would promise them a 2% return per week (this equates to an APY of 180%). When pressed by others on the forum who were skeptical of his motivations after seeing him endorse ponzis he claimed that he would make the funds via ‘arbitrage’, which he described as ‘buy low and sell high’. This is not generally how I would describe arbitrage, where I would favor a description like ‘taking advantage of price differences in an asset across different markets’. It seemed this lending program did not take off and he would later delete the text of this post.

After sensing the trepidation that his idea received, Raphael had a brilliant idea. He would steal the code that had leaked from Bitcoinica, (archive) a recently failed exchange with known security issues that had been created by a teenager, and use that to start his own exchange. Thus, Bitfinex was birthed.

Bitfinex early on differentiated itself from the competition thanks to a couple of largely unique features. The first was Bitfinex’s ‘meta-exchange’ feature that allowed for you to trade on Mt. Gox and Bitstamp as well as Bitfinex all from the same interface. This did however mean that often Bitfinex would have a significant portion of their assets on other exchanges, including at one point having half of their funds on Mt. Gox, during the period while it was being hacked.

The second feature that helped attract traders to Bitfinex was that they had features that allowed for people to lend out their crypto, and to get loaned crypto. This allowed for people to earn yield on their crypto-assets and enabled other people to get additional leveraged exposure to crypto. Since Bitfinex was one of the only places that had any feature like this they were able to attract significant interest from traders.

Early in 2013 Raphael was joined by Giancarlo Devasini who is still today the Chief Financial Officer of both Bitfinex and Tether. Giancarlo Devasini was trained as a plastic surgeon, though that was a short lived career choice. He had his own checkered past before joining Bitfinex, including at one point needing to pay a fine to Microsoft for selling pirated software. (Archive) Giancarlo also ran an electronics business known as Perpetual Action Group that appears to have have had some issues, including getting banned from the marketplace Tradeloop due to an incident in which a customer claimed his shipment of memory turned out to be a block of wood. (Archive)

Giancarlo was also likely responsible for bringing on his business partner from Perpetual Action Group JL Van Der Velde, the current Chief Executive Officer for both Bitfinex and Tether, onboard to help with Bitfinex. While Giancarlo took care of the European branch of Perpetual Action Group, JL was the CEO of Perpetual Action Group – Asia. He has always had an extraordinarily difficult role to explain as he never makes public statements, and despite being the CEO of two separate multi-billion dollar companies he is still actively the executive director for an automotive company and a venture capital firm.

The story for Tether ostensibly starts in July of 2014. (Archive) Several members of the MasterCoin foundation including Brock Pierce, Craig Sellars, Reeve Colins, and William Quigley came together to start a project called RealCoin that was going to be the first dollar-backed token on the blockchain. Brock Pierce was likely the most controversial of these founders. He had previously been sued for child sexual abuse (archive) (charges voluntarily dismissed) and had run away to Spain with an indicted child sexual predator, where both got arrested in a house with tons of child pornography (archive) (Brock was released without being charged). At some point during the summer the ownership of this switched from the original group of founders to the executives of Bitfinex. On September 5th 2014 Tether Holdings Limited was founded by Phil Potter, Chief Strategy Officer of Bitfinex at the time, and Giancarlo Devasini. (Archive) Shortly thereafter the very first Tethers were printed on October 6th 2014. (Archive) (Bitcoin/Omni Transaction ID: ce36efda15bc6cf99ba6a010e71b47b00a5ea2071a392839effe7ed392cf690f) Tether would promise from the very beginning that they would be getting regular audits. No audits have ever been obtained.

In May of 2015 Bitfinex was hacked. Their hot wallet with 1500 Bitcoins was drained, however they were able to cover it out of corporate funds. The overall ecosystem still believed strongly in Bitfinex’s positioning and this hack does not seem to have adversely affected them.

However, things became significantly more complicated in June of 2016 when Bitfinex settled with the Commodities and Futures Trading Commission and paid a $75,000 fine for “offering illegal off-exchange financed retail commodity transactions in bitcoin and other cryptocurrencies“. Part of the central issue in this case is that the Bitcoins from the futures were not ‘physically delivered’, to potentially solve this problem Bitfinex sought out the services of BitGo. BitGo was a multi-signature wallet provider who could potentially allow them to segregate each user’s balance (archive) allowing for them to ‘physically deliver’ the Bitcoins.

Unfortunately, shortly after this implementing this new wallet infrastructure Bitfinex was hacked again. In August of 2016 119,756 Bitcoins were withdrawn from Bitfinex’s wallet in what is still one of the largest hacks ever. In response Bitfinex claimed to give all of their clients a 30.67% haircut. (Archive) For each dollar they took in the haircut the users would receive a single BFX token. Later reporting by Nathanial Popper at the New York Times would suggest that this was a lie, and at least one client avoided the haircut. It is unclear how many other clients also may have avoided the haircut. Users anticipated that Bitfinex could potentially manipulate things in exactly this manner, and as such Bitfinex promised to reveal their methodology for calculating this haircut. (Archive) This methodology was never provided. They also promised that they would provide a security audit and a financial audit to help assuage fears surrounding Bitfinex. They initially hired Ledger Labs to provide the security audit (and they claimed the financial audit). (Archive) If this security audit occurred it was never released. Eventually Friedman LLP would be hired to audit Bitfinex. (Archive) No update on this audit was ever provided.

Those who received BFX tokens had two potential options: wait for Bitfinex to pay them off or convert them to Bitfinex equity. Many seem to have chosen to convert to equity and thus became enthusiastic supporters of Bitfinex. The rest luckily had their tokens paid off in March of 2017.

Also in March of 2017 Bitfinex and Tether were cutoff from banking. Wells Fargo, their correspondent bank refused to service them any longer and in response Bitfinex and Tether filed a suit that was described by their Chief Strategy Officer Phil Potter as solely an attempt to ‘buy time’. This lawsuit would be dropped days later. It is unclear exactly how the timeline went for paying off all outstanding tokens, and getting cutoff from banking.

Bitfinex was able to quickly find banking at Noble Bank, an International Finance Entity, that was founded by Brock Pierce. However from March 2017 through the middle of September 2017 Tether had no banking account. This would be the first period where Tether would be definitively unbacked. The only cash holdings they had was ostensibly held in trust at the account of Stuart Hoegner, the general counsel for both Bitfinex and Tether. Stuart Hoegner had previously been the Director of Compliance for a non-compliant poker site that allowed some players to have a ‘god-mode’ where they could view other players cards. The account where he held the Tether backing had approximately $61.5 million in it. (Archive) (My copy) The remainder of Tether’s backing was a receivable from Bitfinex’s account at Noble, however, that account received deposits from only two clients, neither who purchased Tethers. (Archive) (My copy) Inexplicably, the number of Tethers in circulation grew from approximately $35 million to $440 million during this period.

Finally, in September of 2017 Tether announced that they had retained Friedman LLP to provide them with an audit. (Archive) (They also released several previous attestations) This audit would never occur, with Tether citing the “excruciatingly detailed procedures” (archive) that Friedman wanted to undertake. However, Friedman did provide a consulting memo not for public release on September 15th 2017.

The timeline for this report is important for us to take a look at. On September 14th Tether had no bank accounts. On the morning of September 15th Tether finally got an account at Noble Bank, which again was co-founded by Tether co-founder Brock Pierce. At some point during the day on September 15th hundreds of millions of dollars were transferred from Bitfinex’s Noble account to Tether’s. The attestation occurs that evening. Tether was very carefully moving around this money on the same day that the attestation was going to occur, in order to ensure that it appeared that every Tether was backed.

In November of 2017 Tether was hacked Approximately $30 million was withdrawn from the Tether treasury, and in response Tether ended up using their dominant economic position to force a hard-fork of the Omni layer. (Archive) Shortly thereafter, they also added a feature that would allow them to freeze Tethers that were in circulation. Similar to the two Bitfinex hacks, no post-mortem was ever provided for this hack. This hack in particular was extraordinarily strange because it may have been committed by the same person who hacked Bitstamp in 2015 and Bitfinex in 2015.

In June of 2018 Tether responded to public pressure by getting another consulting memo (archive) meant to convince people that they were fully backed. This memo was provided by a law firm called Freeh, Sporkin, and Sullivan. Somewhat problematically Eugene Sullivan was one of the advisors to their bank, Noble Bank. Louis Freeh had also previously worked Brock Pierce and John Betts (the other founder of Noble Bank) at Sunlot when they tried to acquire Mt. Gox. Shortly after this, things get quite bad for Bitfinex and Tether.

Since Bitfinex and Tether had often struggled with banking they relied on Crypto Capital Corp, a Panamanian based payments processor to help them. Eventually Tether and Bitfinex would end up giving over $1 billion of commingled client and corporate funds to Crypto Capital Corp and would never signed contract or agreement of any kind. Several of the executives for Crypto Capital Corp have since been arrested, and Crypto Capital Corp is implicated in: wire fraud, bank fraud, embezzling, counterfeiting, and money laundering for the Colombian cartels.

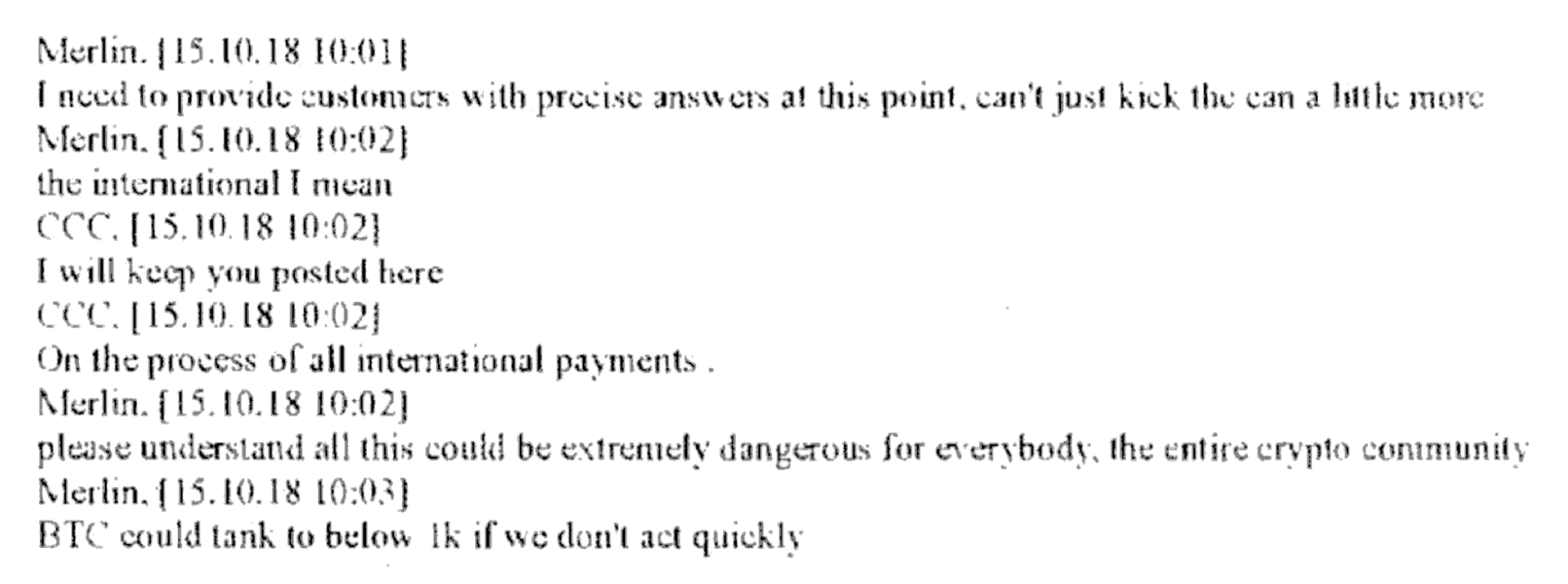

During the summer of 2018 Crypto Capital Corp would stop responding to Giancarlo’s requests for withdrawals. In response to this Bitfinex began taking hundreds of millions of dollars from Tether’s bank account and making a book notation that Tether was now owed funds from the inaccessible Crypto Capital Corp accounts. This was the second period where we definitively know Tether was unbacked.

This continued for several months as Bitfinex lied to the public about the status of their withdrawals and solvency. (Archive) Privately at this same time Giancarlo was desperately messaging Crypto Capital Corp to get any funds they could. A couple short weeks later Tether announced that they were banking with Deltec Bank and Trust in the Bahamas and as part of the announcement they released a letter showing that Tether’s ‘portfolio cash value’ was sufficient to back all Tethers in circulation.

On November 2nd, the day after this letter was released, Bitfinex again took hundreds of millions of dollars from Tether’s account, Tether was again credited with funds at the inaccessible Crypto Capital Corp accounts. This is the third period we definitively know that Tether was unbacked.

In February of 2019 Tether finally updated their terms-of-service and their website to honestly reflect the fact that Tether was not backed by cash. This had been true at times since at least March of 2017.

In March of 2019 Tether and Bitfinex would enter into an extraordinary agreement where Tether would extend a revolving line of credit to Bitfinex of up to $900 million at 6.5%. The loan was collateralized with shares of iFinex inc and was signed by the same individuals for both companies.

Finally, in April of 2019 when the New York Attorney General became aware of this strange loan agreement they filed for an ex parte order (archive) against Bitfinex and Tether to prevent this type of transaction. This set off over a year of jurisdictional jockeying in the courts, until eventually Tether and Bitfinex agreed to a settlement where they would no longer do any business in New York and would also pay a fine.

Since then Tether has largely continued to grow, though not without increased scrutiny. They have released reserve breakdowns that now show they have only $0.03 in cash for each tether in circulation. Recent Bloomberg reporting also suggests that Tether executives received target letters from the Department of Justice for bank fraud. (Archive) (Which I believe they committed) It is unclear what the future holds for Tether, but they continue to hold an important and fraught role in the cryptocurrency ecosystem.

If you would like to subscribe to my free newsletter then please go here.

If you want the posts from this blog delivered to your inbox:

I also have a Discord server that you can join here.

7 thoughts on “Tether and Bitfinex Introduction”